Hiring staff – whether salaried or contracted – is a huge growth moment for a business owner. Not only does it prove your business’ resilience (you can afford to pay your overhead, yourself, and someone else!) it also signals your enterprise’s maturity. However, every hiring decision can be a make it or break it decision, especially for smaller organizations. After all, your new hires deliver your services, handle your invoicing, and interact with your customers. Those are all critical areas of your business, and your hires must fit your organization both by skill set and by staff type.

While skill sets can vary wildly depending on how you do business and the kind of industry in which you operate, staff types to choose from are limited to two different categories: contractor or employee. Each of these designations comes with its own set of criteria, considerations, and tax requirements. For this blog, we’ll focus on your contractors – who they are, what you need them to sign when you hire them, and what tax forms you need to issue on their behalf each tax season.

What is a Contractor?

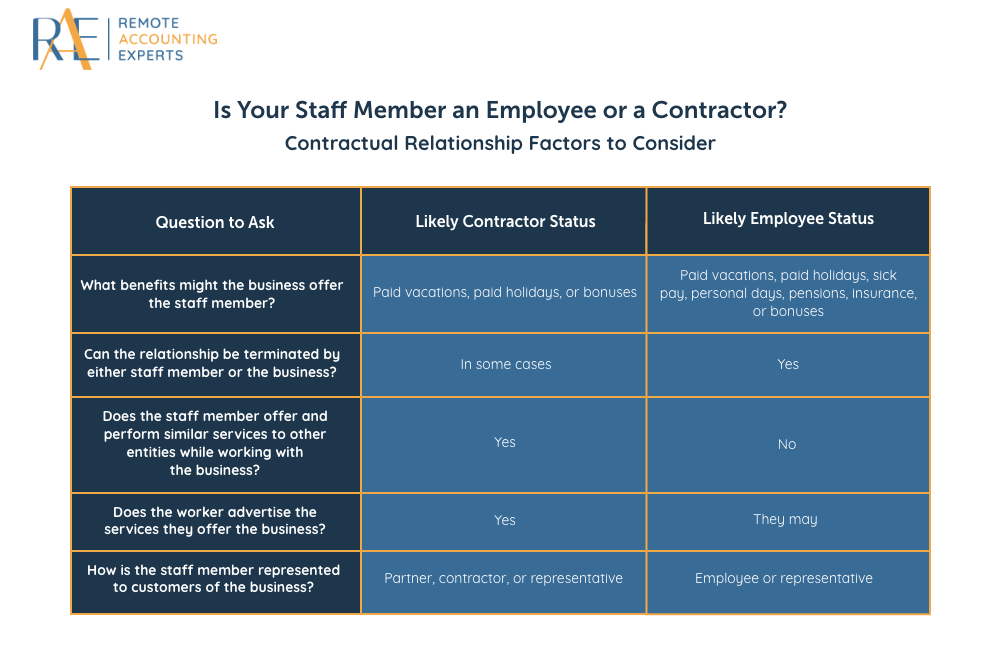

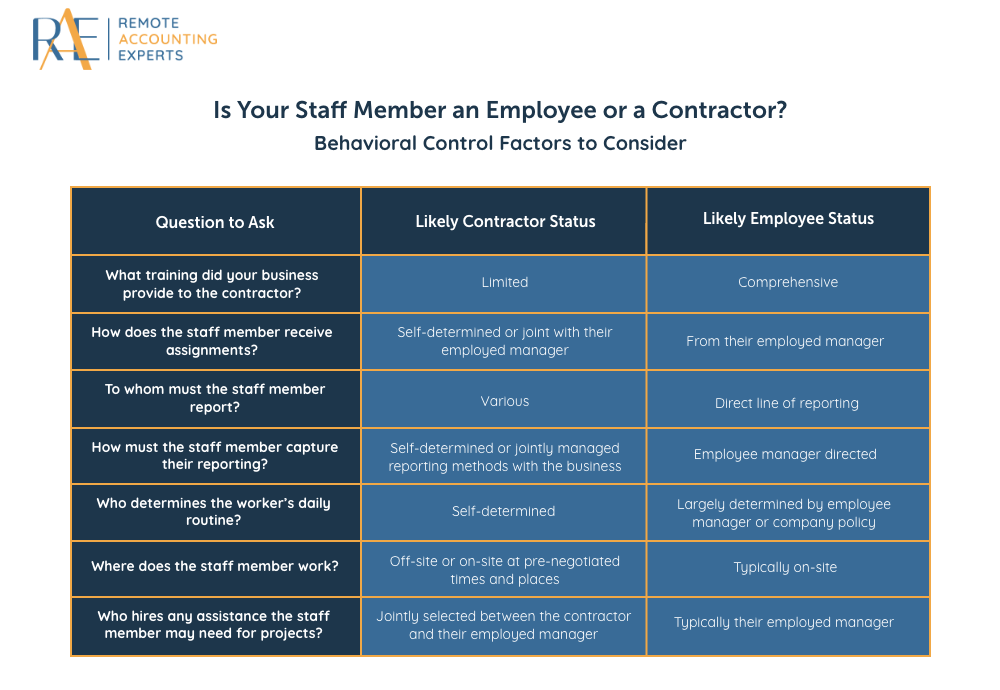

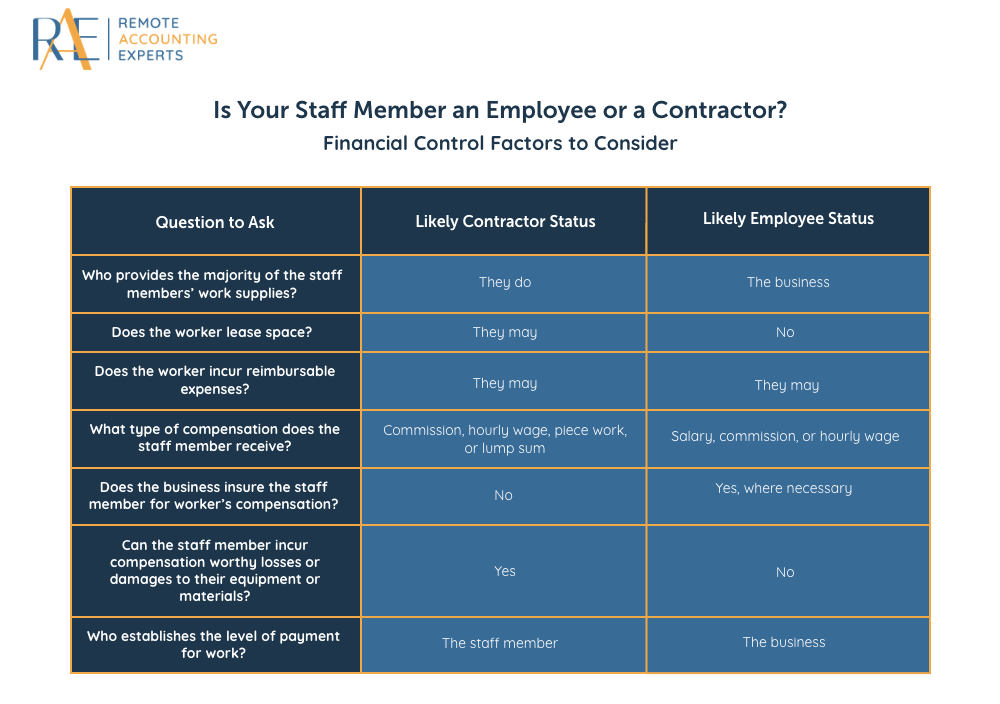

U.S. and state labor organizations have three criteria they set out to help business owners determine whether or not their staff member is a contractor or an employee. These categories are: behavioral control, financial control, and contractual relationship. Government organizations recommend that business owners analyze questions like the following in each of three these categories to determine whether they should follow the process for contractor hires or employee hires:

So, You’ve Hired a Contractor. What’s Next?

Once you hire a contractor, you’ll need to set them up with your business. Aside from project briefing and any training, that means that you need to have them complete a W-9 form. This gets you their correct identity and tax information on file so that you can send them the correct tax forms at the end of the year. Once you have their completed W-9 in your possession, send it to your accountant to keep on file for that calendar year. We recommend requesting an updated version of this form, from each of your contractors, every calendar year during which you employ them.

One important thing to note here – we advise letting your contractor know whether or not you are willing to withhold taxes for them before they complete this form. They will need to know this information in order to fill out the form fully, and if they request tax withholding, that’s something that you or your accountant will need to manage for them during the term of your contract.

What IRS Form to Send Your Contractor at Tax Season

If you’ve paid your contractor at least $600 during that year’s tax period using cash, check, or a third party app like Zelle or Venmo, you’ll need to send them a 1099-NEC form come tax season. There are only three exceptions to this rule. You won’t need to send this form if:

Your contractor is a C or S corporation, or if they are an LLC that chooses to file as a C or S Corporation.

Payments of contractor freight or merchandise expenses are what bring your total amount paid across the $600 threshold.

You’ve paid your contractor through a third-party app like Venmo or PayPal that you’ve set up as a business account. In this situation, Venmo or PayPal will be the party that issues your contractor their 1099. However, this will only happen if you’ve made that third-party account a business one. If it is a personal account, you will need to treat the contractor payments like those made as cash payments, and send your contractor their 1099-NEC if those total more than $600.

Navigating new hires and the paperwork that comes with them can be overwhelming at first, but with practice and time, the process of qualifying contractor versus employee and organizing the resulting logistics will get easier. If you’re just getting started in your hiring journey or want some guidance on which forms to send when and to whom, contact an accountant like Remote Accounting Experts to walk you through the process and what it takes to keep your business in good standing with the IRS.