If you are a small business owner or entrepreneur, you may be tempted to try and save money by doing your own accounting and bookkeeping. However, bookkeepers are an integral part of any business. They keep track of the finances and make sure that everything is in order. Many business owners try to do this on their own or do not have someone who can do it. But a professional bookkeeper can help you save time and money. They know what they’re doing and can help you stay organized.

Below, we’ll explore the value of a good accountant or bookkeeper and how they can give you the edge you need over accounting and bookkeeping apps or software!

1. Bookkeepers Can Help You Make Better Business Decisions

At its most basic level, bookkeeping is the process of recording and tracking financial transactions. Your bookkeeper can help you do this and point out trends, highlight areas of concern, and offer real world, business informed advice on how to improve your bottom line. A bookkeeper will help you understand your financial statements, make better business decisions, and assist you in forecasting future expenses. They can also help you manage cash flow and take advantage of any tax deductions that might be available to your business.

That’s much more helpful to growth focused entrepreneurs than an app or tool that just spits out numbers without the insights needed to drive decision making.

2. Advice on Tax Planning and Reducing Tax Liability

While most bookkeepers focus on tracking transactions and preparing financial reports, some also offer services like tax planning. With their in-depth knowledge of the tax code, bookkeepers can provide valuable advice on how to minimize your tax liability. They can help you take advantage of deductions and credits that you might not otherwise be aware of, and they can also recommend strategies for reducing your taxable income. Additionally, bookkeepers can help you stay on top of important deadlines and make sure that your tax returns (or extensions, should you need them) are filed on time.

3. They Can Tailor a Bookkeeping System to Your Business’ Needs

When it comes to running a successful business, your bookkeeping is a critical thing to get right. Having accurate and up-to-date financial records is essential for making sound business decisions, managing your cash flow effectively, and complying with tax requirements. Designing and maintaining a bookkeeping system that meets these needs can be daunting, but thankfully professional bookkeepers can help.

A good bookkeeper will not only set up a system that is tailored to your business, but they can also train you and your staff on how to use it properly. This will ensure that your bookkeeping is always accurate and up-to-date, giving you the information you need to make the best decisions for your business.

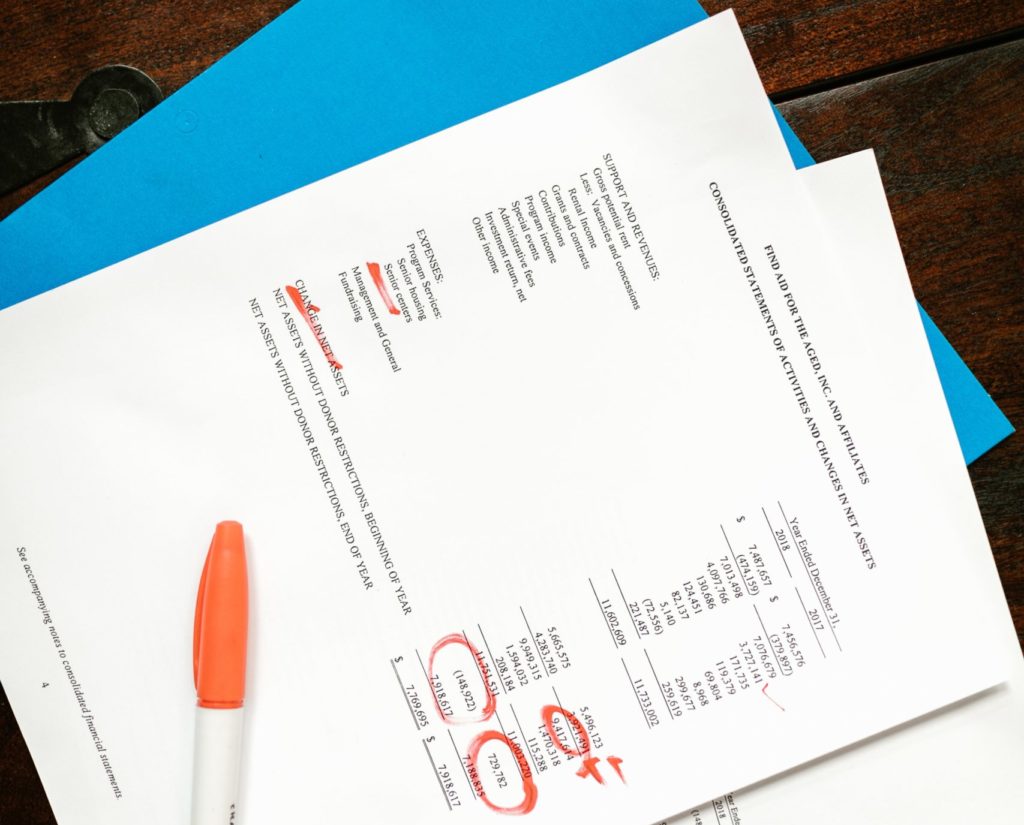

4. They Can Review Your Business Finances for Accuracy

We all know how important business finances are, but staying on top of everything can be challenging. This is where an accountant or bookkeeper can be a valuable asset.

An accountant can act as a second pair of eyes to review your financial transactions and ensure accuracy. They can also offer advice on how to improve your financial management. An accountant can even help you prepare for tax season by checking that all of your paperwork is in order. Whether you’re a small business owner or an individual with a complex financial situation, an accountant can give you the peace of mind of knowing that your finances are in good hands.

5. Bookkeepers Can Save Your Business Time and Money

Hiring a bookkeeper is an important decision for any business owner. A bookkeeper keeps track of your finances and ensures that your books are up to date. They can help you identify areas where you may be overspending or where you can save money, and are also a valuable resource when it comes to tax preparation. All of that together is why working with a bookkeeper can save you both time and money in the long run.

When it comes to your finances, don’t go it alone – hire a professional bookkeeper! Whether you run a small business or a large corporation, having a bookkeeper on your team is a smart move.

Don’t wait – contact us today at Remote Accounting Experts to learn more!