Working for a nonprofit organization can be both fulfilling and challenging. No matter what you do for the organization, you’ll likely find that it’s a lot different than the corporate world. For example, you may find differences in the organizational structure in a nonprofit organization.

It’s important to remember that nonprofits operate under a different set of rules and best practices than their for-profit counterparts. That is true throughout the organization, including with anyone who handles the money. For example, you probably know that the Internal Revenue Service (IRS) has unique rules for charities and other nonprofits.

If you are working in accounting in a non-profit organization, you already know that you need to follow all the laws and official regulations. But there are some less-formal guidelines that can help you thrive as well. Here are just five of the most important best practices for accounting departments in nonprofit organizations to follow:

1. Protect Your Organization from Fraud

According to the Nonprofit Risk Management Center, nonprofits lose a median amount of $100,000 to fraud every year. For many organizations, that is a significant amount of money that could have been better spent improving lives. Furthermore, fraud risks the nonprofit’s reputation, which can spell doom for any organization that relies on public contributions.

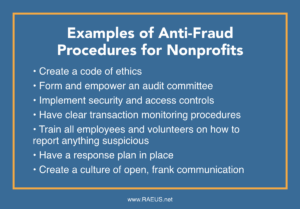

One of the best things you can do to protect your organization against fraud is to write, implement, and enforce strict accounting and bookkeeping anti-fraud procedures. There are many ways to go about forming your anti-fraud procedures, and the specifics may vary depending on your organization’s structure. An Association of Certified Fraud Examiners (ACFE) study showed that simply having these procedures in place deters fraud.

2. Assign Financial Tasks to Many People

Another way that nonprofit organizations can deter and detect fraud is to have more than one person working on financial tasks. When all financial duties rest in the hands of one or just a few people, it’s easier for someone to defraud the organization from within or fall victim to a fraudster.

The more people who have eyes on the organization’s finances, the more checkpoints exist to defend against fraud. This isn’t to say that every person should have visibility into every detail of your organization’s books. Instead, financial responsibilities should be spread across the organization.

In some cases, you may want to outsource financial tasks to a trusted partner, especially if your team isn’t comfortable managing those critically important details. A dedicated, knowledgeable group of accountants can help.

3. Work Closely with Other Departments

In any organization, it’s important to avoid silos. It’s even more vital in nonprofit organizations. The accounting department should make sure to connect and regularly meet with other areas of the nonprofit. Remember, you’re all one team working toward a shared vision.

When the accounting department is well-connected to the rest of the organization, you can avoid financial emergencies and mistakes. For example, imagine the fundraising department is behind on their goals for the year. Maybe a big donor decided not to give this year.

If you mostly keep the situation with the donor to yourself, you likely won’t hear about the issue with fundraising goals until the information trickles down. At that point, it can feel like an emergency. But what if you knew about an incoming problem weeks before? Building trust and kinship with the other departments makes it likely that issues get communicated sooner. Then you can all work together to put out the fire before it gets too big.

4. Keep Your Goals and Budgets Realistic

Many people are drawn to a career in the nonprofit sector because they want to do good. They see a problem that they want to solve in the world, and they decide to dedicate their careers to making things better. This is an excellent driving force, and keeping that mission in mind can serve you well most times. However, it’s important to also stay tethered to the numbers in black and white.

When it comes time to set your organization’s operating budget, make sure to keep things realistic. In nonprofits, there is a tendency to shoot for the moon and expect that people will donate as much as they said they would. Unfortunately, it doesn’t always work out this way. Donations fall through, prices rise, and other problems may occur.

Instead of scrambling when issues arise, plan for them. Make sure you have a cushion in your operating budget that accounts for things going wrong. Then, if it does, you’ll be better equipped to fix it.

5. Only Outsource to Nonprofit Experts

It’s natural that you may not be able to do everything in-house. After all, nonprofits are often made of efficient, small groups who work hard. When you decide to outsource, make sure your new vendor is well-versed in nonprofit rules, expectations, and challenges.

For example, make sure the accounting software you use has what you need. Not every software package is built with nonprofits in mind. Furthermore, you can find a team of accounting experts with nonprofit experience to help your team achieve its goals.

At Remote Accounting Experts, we are proud to serve a wide variety of organizations, including nonprofits and small businesses. Our team of knowledgeable accountants can help you with anything from bookkeeping and in-house accounting to data entry and tax filing. Contact us today to get started.